NFT Collection The Superlative Secret Society Price, Stats, and Review

Apertum Gets Rewarded as Fastest-Growing Blockchain Community

Analyst Predicts Bitcoin Rally Despite Tariff Pressure: Is the Bear Trap Set?

Wall Street’s one-day loss tops the entire crypto market cap

SEC Sets Clear Guidelines for Fiat-Backed Stablecoins

Pi Network on Free Fall, 4 Reasons Pi Coin Price Going to $0.1

Forget Bitcoin And Gold—Kiyosaki Says This Asset Dominates Them All

What happened in crypto today? Rate cuts, regulation, and the impact on Bitcoin

Binance Data Reveals Surprising Bitcoin Trading Patterns—Here’s What Traders Are Doing

Ethereum Whales Make Bold Moves: Massive Accumulations Signal Confidence

eToro Referral Code: Get $30 Sign-up Bonus

Bitcoin Outshines Tech Stocks, Strengthens Role as Dual-Purpose Asset

Liberation for Bitcoin From Equities?

HashEx Security Alert – A Single Signature Could Drain Your Wallet

US Treasury Targets Houthi Crypto Wallets, Financial Network

Dogecoin Open Interest Suffers Further Crash, Will DOGE Price Continue To Go Down?

BitMart Referral Code (c7VS5a): Steps to Earn Free $8000 USDT in 2025

Bitcoin: Coinbase sees 2,500 BTC inflow in one block—Are whales looking to exit?

SEC paints 'a distorted picture' of USD-stablecoin market — Crenshaw

Russia Addresses US Tariff Threats as BRICS Ramps up Dollar Escape Plan

Bitcoin Short-Term Holders Halt Buying Activity – What Does This Mean For BTC?

CZ Advises Governments on Crypto Regulations and Blockchain Efficiency

Bitcoin traders prepare for rally to $100K as ‘decoupling’ and ‘gold leads BTC’ trend takes shape

U.S. House greenlights STABLE Act – A game-changer for stablecoin regulation?

Bitcoin Realized Price Model Signals Correction May Still Have Weeks To Run – Details

Chainlink (LINK) Whale Transfers Spike, Bearish Sign?

On-chain data shows that Chainlink (LINK) whales have become quite active in recent days, a sign that may be bearish for the asset’s price.

Chainlink Whale Transactions Have Shot Up In Number Recently

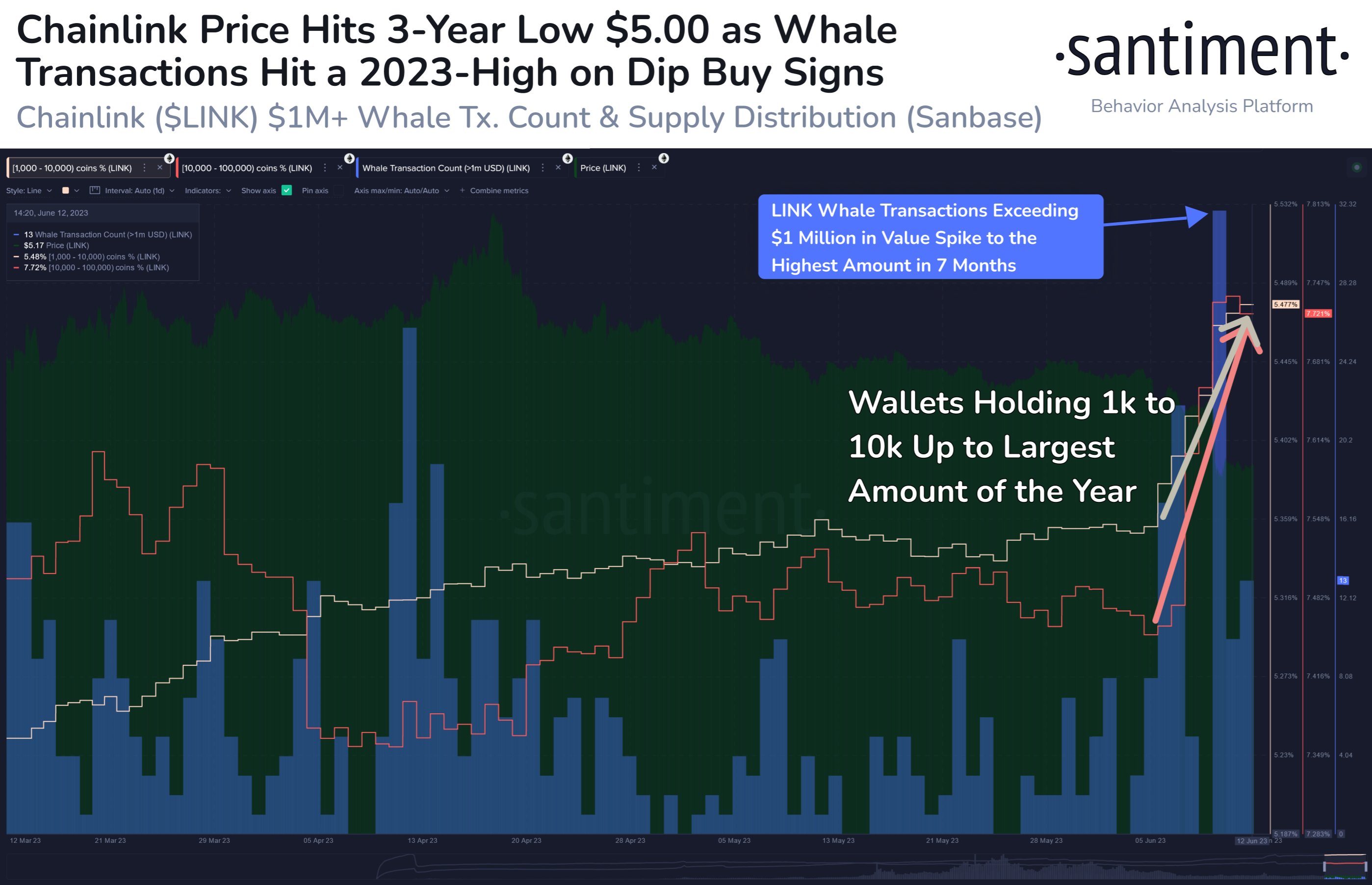

According to data from the on-chain analytics firm Santiment, whale transactions hit a 2023 high just as the price dipped toward the $5 mark. The “whale transaction count” is an indicator that keeps track of the number of Chainlink transfers taking place on the blockchain that involve the movement of tokens worth at least $1 million in value.

When the value of this metric is high, it means that there are a large number of sizeable LINK transactions occurring on the network right now. Generally, transfers worth more than $1 million are thought to be coming from the whales, so this kind of trend can be a sign that the whales are active currently.

On the other hand, the low values of the indicator imply the whales aren’t making that many moves at the moment. As whale transactions are quite large in scale, a lot of them happening at once can cause fluctuations in the market. Thus, a lack of them happening (that is, low values) can result in a more stable market.

Now, here is a chart that shows the trend in the Chainlink whale transaction counts over the last few months:

As displayed in the above graph, the Chainlink whale transaction count saw a couple of spikes during the last week or so. This would hint that whales of the cryptocurrency may have been actively trading in this period.

These high values of the indicator took place simultaneously with the asset’s price sliding down and hitting a three-year low of around $5, implying that at least some of the transactions may have been made for selling-related purposes.

Interestingly, the whale activity continued to remain elevated even after the coin hit its $5 local bottom and saw a rebound. In fact, the largest of the metric’s spikes, which set a new high for the year 2023, came just as Chainlink bottomed out.

The timing of this extreme elevation in the whale transactions may be a sign that some of these humongous investors saw the dip as a profitable buying opportunity and participated in some accumulation, leading to the price being able to rebound.

In the chart, Santiment has also displayed the trend in the supplies of the investor groups holding between 1,000-10,000 LINK and 10,000-100,000 LINK. Both these cohorts seem to have done some buying recently as their supplies have shot up, implying that market-wide buying may have taken place at the lows.

Since the bottom, however, Chainlink has only seen a minute increase as it’s still trading quite near the low itself. Whale transactions are also still at higher-than-average levels for the year, and it’s hard to say what behavior these investors may be showing this time.

Naturally, if the whales are still selling, then LINK might see further bearish price action in the near future.

LINK Price

At the time of writing, LINK is trading around $5.2, down 15% in the last week.