NFT Collection The Superlative Secret Society Price, Stats, and Review

Dogecoin (DOGE) Plunges to $0.20: Is This the Bottom or More Pain Ahead?

Ethereum’s 4-year cycle hints at breakout – Will history repeat itself?

Shiba Inu Price Analysis: 4.3 Trillion SHIB Tokens on the Move – Are Memecoin Whales Buying the Dip?

Crypto Market Today Feb 3: BTC Slumps To $91K, ETH & Meme Coins Crash 20%

Charles Hoskinson to Launch PAC Aiming to Make Wyoming Tech

XRP Price Crashes Hard: Is There a Recovery in Sight?

Bitcoin transaction count at lowest despite rising bullish signs – Why?

Bitcoin and altcoins crash after Trump’s tariff announcements spook investors

Is Doge Uprising the Next Big Crypto? Shiba Inu Price Prediction & Bonk Market Outlook (2025)

Ethereum Price Tanks 25%: What’s Next After the Major Decline?

Key Levels to Watch as Bitcoin Price Crashes Below $100K Today

Shibarium’s rise: How the new L2 impacts Shiba Inu’s price, burn rate

Bitcoin Price Nosedives Nearly 10%: Panic or Buying Opportunity?

BRICS Currency Plans? Russia Says Investment Comes First

Bitcoin Crashes Below $93K, Triggering $1.23B in Liquidations as Crypto Markets Spiral

Virtuals Protocol sinks below $2 – New lows incoming?

Litecoin ETF Likely To Be Approved Before XRP, According to Bloomberg Strategist: Report

Robert Kiyosaki Warns of Bitcoin Crash as Trump’s Tariffs Take Effect—Plans to Buy the Dip

Is Fartcoin poised for a rebound? Key levels to monitor

Sam Bankman-Fried Appeals Conviction, Claims Judicial Bias

Former Binance Executive Warns: Trump Tariffs Pose Biggest Macroeconomic Risk in 2025

Ripple (XRP) Price Forecast: XRP Deposits on Binance Drops $1.3B to Hit 40-Day Low – Is It Bullish?

This $0.08 altcoin might overtake DOGE with massive growth

India Imposes 70% Tax Penalty on Undeclared Crypto Gains

Market Outlook: Trade Wars and Filthy Fiat Battles Fuel Crypto Prices

A slew of digital currencies have gathered decent gains over the last 48 hours and the entire market capitalization now stands at around $308 billion. Moreover, cryptocurrency trade volumes have kicked up a notch, capturing $66 billion in swaps over the last day. Overall, speculators think the recent spike in crypto prices is due to the overwhelming economic uncertainty worldwide.

Also Read: Tax Expert: IRS Letters Confirm That Trading Cryptos Is a Taxable Event

Despite Traditional Market Downturn, Crypto Markets See Steady Gains

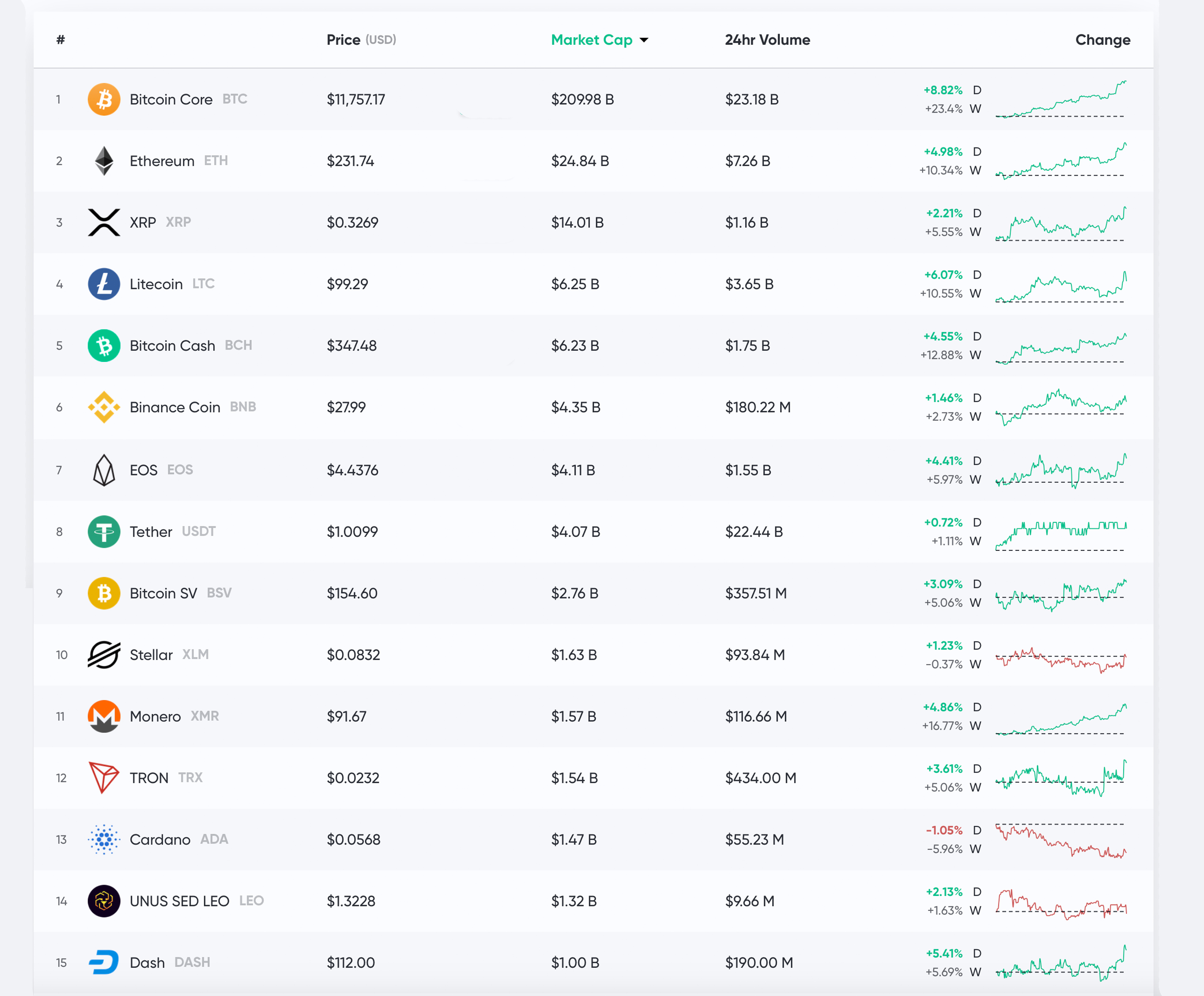

Cryptocurrency prices have jumped northbound once again as a large number of digital assets have seen gains between 2-15% over the last 24 hours. At the time of publication, the price of bitcoin core (BTC) is hovering just below the $12K mark at $11,757 per coin. BTC is up over 8% in 24 hours and has a market valuation of around $209 billion. The cryptocurrency is up 23% over the last seven days and there’s $23 billion in global BTC trade volume on August 5. Right behind BTC is ETH which is hovering around $231 per coin and is up over 4.9% today.

Top 15 digital assets by market cap on Monday, August 5, 2019. If you are looking for a place to buy cryptocurrencies like bitcoin core (BTC), bitcoin cash (BCH), litecoin (LTC), ethereum (ETH), and others get access to these digital assets here.

Top 15 digital assets by market cap on Monday, August 5, 2019. If you are looking for a place to buy cryptocurrencies like bitcoin core (BTC), bitcoin cash (BCH), litecoin (LTC), ethereum (ETH), and others get access to these digital assets here.Ripple (XRP) is up a hair over 2% this Monday and is trading for $0.32 per XRP. In fourth position and the biggest gainer over the last 24 hours is litecoin (LTC) as it jumped 15% after the cryptocurrency’s reward halving took place. LTC dipped a bit afterward but is still up 6% and each LTC is swapping for $99. Lastly, bitcoin cash (BCH) markets are up over 4.5% on Monday as each BCH is trading for $347. BCH is up more than 12.8% for the week and there’s $1.75 billion in global BCH trade volume today.

A Flight-to-Safety Asset

There’s been a whole lot of speculation and analysis with people trying to figure out why digital assets are pumping once again. Many people believe the rise is due to investors looking for a safe haven asset as economic turmoil strikes fear into global leaders. Charles Hayter, the founder of digital currency data website Cryptocompare, believes BTC is being used as a “flight-to-safety.” The crypto price spike started after global stock markets started tumbling when U.S. President Donald Trump told the media he would impose a 10% tariff on Chinese imports.

Some speculators believe capital flight out of China might be priming the current cryptocurrency bull run’s flames.

Some speculators believe capital flight out of China might be priming the current cryptocurrency bull run’s flames.“Bitcoin has many use cases and one of the most important is as a form of digital gold,” Hayter explained on Monday. “We have seen bitcoin jump before on macro uncertainty as it becomes a conduit and flight-to-safety asset.” Etoro’s Simon Peters thinks tensions between the U.S. and China is a plausible theory as well. “Given that Chinese investors make up a large proportion of crypto investors, there’s a strong possibility some are backing bitcoin’s chances against the yuan,” Peters told investors on August 5.

A Looming No-Deal Brexit

It’s very possible that the world could witness a no-deal Brexit in the near future. A while back when people talked about Brexit it meant that the U.K. would leave the European Union (EU) but there were certain agreements tied to the action. This year, a no-deal Brexit means the two countries will divorce and there will be no deals or agreements made when the two go separate ways. Nicholas Gregory, the CEO of Commerceblock, which builds distributed financial infrastructure, believes a no-deal Brexit could push BTC prices past the $20K all-time high.

Commerceblock CEO Nicholas Gregory told news.Bitcoin.com that a no-deal Brexit could spark a BTC rally.

Commerceblock CEO Nicholas Gregory told news.Bitcoin.com that a no-deal Brexit could spark a BTC rally.“Bitcoin has rediscovered its mojo this year with multiple mini-surges but a no-deal Brexit could see a massive and unprecedented breakout. Not only will a no-deal departure from the EU create turmoil and volatility across two major fiat currencies, but it will also trigger an identity crisis for the global system as the contingency and vulnerability of major global fiat currencies is laid bare,” Gregory wrote to news.Bitcoin.com on Monday. The Commerceblock founder added:

Come 2020, we expect an increasingly populist and politically unstable world to cement the safe-haven status of bitcoin and cryptocurrencies more generally. And if central banks revert to ramping up the money printing all over again, the case for cryptocurrencies like bitcoin whose supply is capped will be further reinforced. Each time a central bank increases the money supply, it’s another nail in the coffin of fiat.

‘Rally Could Have Real Legs’ Says Galaxy Digital Executive Mike Novogratz

After cryptocurrency markets spiked this weekend and into Monday, Galaxy Digital CEO Mike Novogratz tweeted that the 2019 BTC rally could be real. The comment follows Novogratz’s recent interview when he told the public that the digital currency could surpass all-time highs in 2019. He attributed the rise in prices on July 25 to the recent Facebook Libra announcement and mentioned Telegram’s coin launch. On Monday, however, Novogratz blamed the global economic uncertainty and capital flight. “With the yuan over 7.0, an FX war, instability in HKG and the beginnings of capital flight, the BTC rally could have real legs,” Novogratz tweeted.

Trade and Currency Wars

Financial analyst Naeem Aslam detailed on Monday that he also thinks economic uncertainty and Donald Trump’s trade wars are helping bolster the price of BTC. “There is no doubt in mind that the Bitcoin price is going to break this year’s high,” Aslam wrote. The FX, equities, and crypto analyst said that crypto bulls can thank Trump for the spike because “it is completely driven by geopolitical tensions.”

Donald Trump’s trade war with China has fueled speculation that people are moving money into digital currencies.

Donald Trump’s trade war with China has fueled speculation that people are moving money into digital currencies.“Donald Trump introduced new tariffs on China last week and I talked about the retaliation action by Beijing. China has unleashed its nuclear weapon on the U.S. This retaliation has come in the form of China introducing the most fearful factor for the markets, a currency war,” Aslam opined. “The Chinese Yuan crossed the level of $7 for the first time and this is only because China clearly wants to devalue its currency.” Aslam further wrote:

We all know what this means for Bitcoin; it is going to explode and continue to move higher.

Bitcoin Cash and Litecoin Markets Spike

BCH has continued to follow the upward trend as the currency has broken a decent path of upward resistance and market analyst John Isige thinks it’s possible BCH could spike to $400 per BCH in the near future. “Glancing ahead, bitcoin cash (BCH) is approaching the rising wedge pattern breakout — Trading above the pattern resistance could boost Bitcoin Cash towards $400,” Isige suggested on Monday. “Moreover, Bitcoin Cash is strongly supported initially by the 50 Simple Moving Average (SMA) 1-hour chart currently at $333.62.”

John Isige notes a rising wedge pattern that could launch BCH towards $400.

John Isige notes a rising wedge pattern that could launch BCH towards $400.Litecoin prices jumped during Monday’s early morning trading sessions due to the cryptocurrency’s reward halving. Before LTC’s block height at 1,680,000, miners got a reward of 25 LTC but now only get 12.5 LTC per block. The halving event gave LTC prices a boost and saw the digital asset rise higher than most coins on Monday. The Litecoin network cuts its mining rewards in half every 840,000 blocks. Since the LTC halving, the digital asset is hovering around the $90-110 range.

Litecoin’s price got a boost from the cryptocurrency’s recent halving at block height at 1,680,000.

Litecoin’s price got a boost from the cryptocurrency’s recent halving at block height at 1,680,000.Recent Federal Reserve Rate Cut Adds Fuel to the Crypto and Precious Metal Market Rallies

Overall, there’s no shortage of digital currency market speculators and pundits giving their two cents on the current crypto rally. A great majority of investors and enthusiasts believe cryptocurrencies are rising because of the world’s economic woes. Alongside cryptocurrencies, the price of gold has reached a six-year high and speculators believe the spike is due to the exact same reasons.

Gold spot prices per ounce on Monday, August 5, 2019 touch an all-time six-year high according to Goldprice.org.

Gold spot prices per ounce on Monday, August 5, 2019 touch an all-time six-year high according to Goldprice.org.Additionally, last week, digital currency markets witnessed the first Federal Reserve interest rate cut in ten years. The Fed told the public last Wednesday that the bank would cut rates by a quarter point. Many economists believe the rate cut is troubling for the U.S. economy and even two regional Federal Reserve presidents publicly spoke out against the interest rate cut. The financial columnist from Barron’s, Ben Walsh, recently explained the Fed’s rate cut could reinforce bitcoin gains.

“The Federal Reserve has added fuel to the rally as it has shifted from raising interest rates in 2018 to keeping borrowing costs steady to its current strong hints that a reduction is on the way,” the author penned last week. “Easier monetary policy could bring more gains for bitcoin.”

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency and gold prices referenced in this article were recorded at 11:45 a.m. EST on Monday, August 5, 2019.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Getty, Goldprice.org, Wiki Commons, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Outlook: Trade Wars and Filthy Fiat Battles Fuel Crypto Prices appeared first on Bitcoin News.