NFT Collection The Superlative Secret Society Price, Stats, and Review

XRP Price Analysis: Bulls Eye $2.20 Breakout Amid Choppy Action

Bitcoin short-term holders control 40% of market wealth – What this means for BTC

Ethereum Eyes a Comeback After Brutal Q1 Slide

Bitcoin’s quantum-resistant hard fork is inevitable — It’s the only chance to fix node incentives

New Android Malware ‘Crocodilus’ is Snapping Up Crypto Funds

DWF Labs offers to help projects hit by ‘weird dump’ on Binance

BNB price nears breakout as Binance Coin burn rate gains steam

This $0.024 altcoin could give better gains than XRP

Mastercard working on blockchain to connect TradFi and crypto: report

Crypto Market Crash: BTC, ETH, XRP, DOGE Fall Following Weak PMI, JOLTS Data

Grayscale moves to convert Digital Large Cap Fund into ETF: what it means for investors

Bybit to shut down NFT marketplace as trading volumes decline

Hashgraph Announces HashSphere: Permissioned Blockchain for Compliant Finance

BlackRock admits: Bitcoin is a threat to the US dollar

Bybit Leads March Capital Inflows and Reclaims No.2 in Trading Volume

Brazil Bans Retirement Funds From Investing in Cryptocurrency

Bybit Web3 Announces Streamlining of Offerings to Enhance User Experience

Top 4 Ethereum Rivals to Turn $1k to $100k Before Aprill Ends

DOGE, BTC, ETH Price Prediction: Fed Trump Warning on Interest Rates

8 Best Free Bitcoin (BTC) Cloud Mining Platforms to Earn Daily Passive Income at Home in 2025

BNB Chain Completes Pascal Hard Fork, Aims for Significant Speed Improvements with Lorentz and Maxwell

Hedge fund warns: Bitcoin price could fall to $50,000 this year

2025’s Best 5 Free Cloud Mining Apps for Android & iOS – Safe, Legit and Profitable Bitcoin Mining Tools

An analysis of Zcash’s founders reward

With all the attention that has been brought to Zcash, Electric Coin Company, and the possibility of an extension to the founders reward, we will examine the founders reward and estimate approximately how much capital has been brought in to date for each recipient.

Electric Coin Company, the central company behind the development of Zcash, has been operating at a deficit, spending about $880k per month for during the second half of 2018 ($700,000 for monthly expenses and an additional $180,000 as additional compensation to employees) and plans to increase its operating expenses to approximately $1.1 million per month.

The founders reward is set to end in November 2020 and Electric Coin Company’s current estimates have it depleting its runway within 24 months. The firm has noted that if its runway were to dip below about about a year it would be forced to pivot its attention and resources away from the development of Zcash to generate other revenue streams.

The Founders Reward

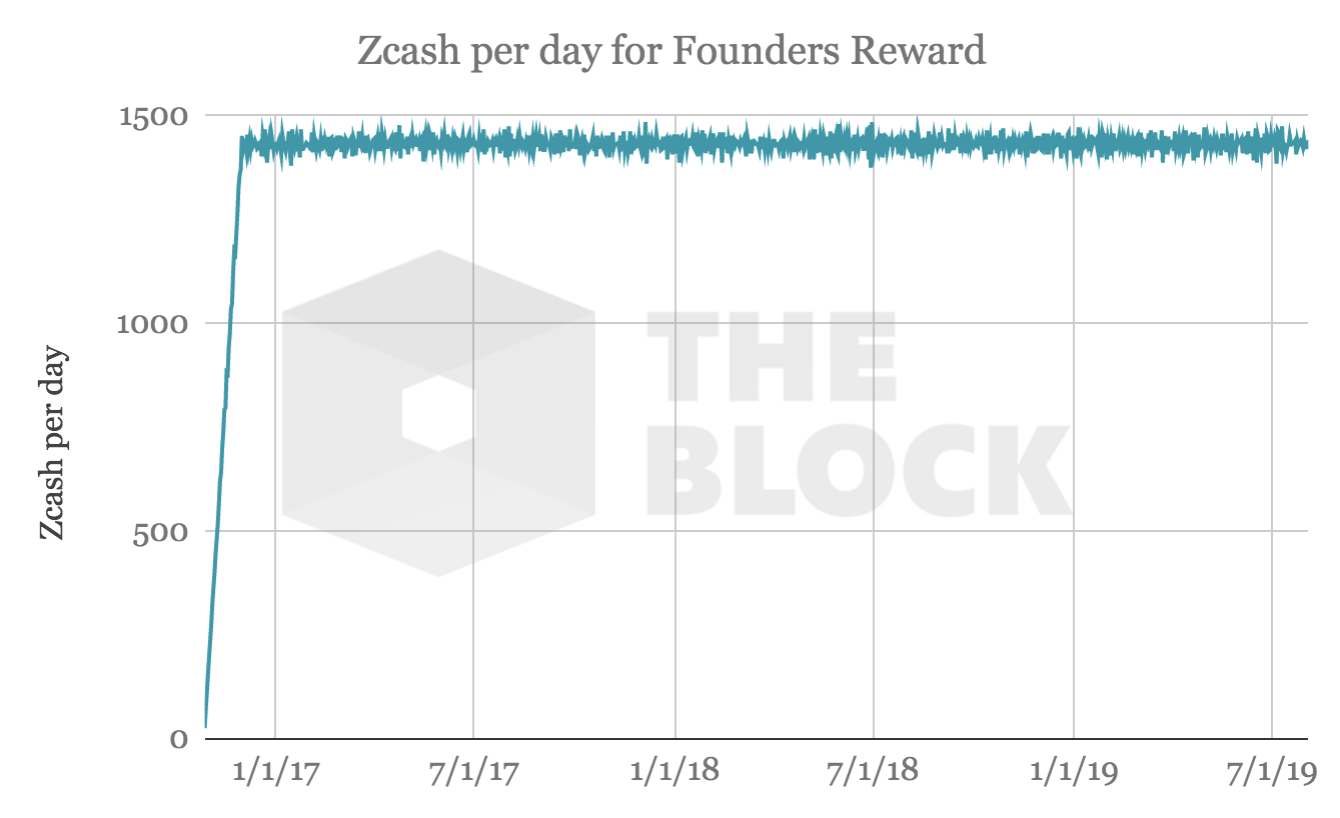

Over approximately four years, recipients of the founders reward have been set to receive $2.1 million ZEC or 10% of the total supply of ZEC that will ever be produced. Founders reward recipients include investors who provided capital to jump start Electric Coin Co., the founders and vested employees, Electric Coin Co. and employee compensation, and the Zcash Foundation.

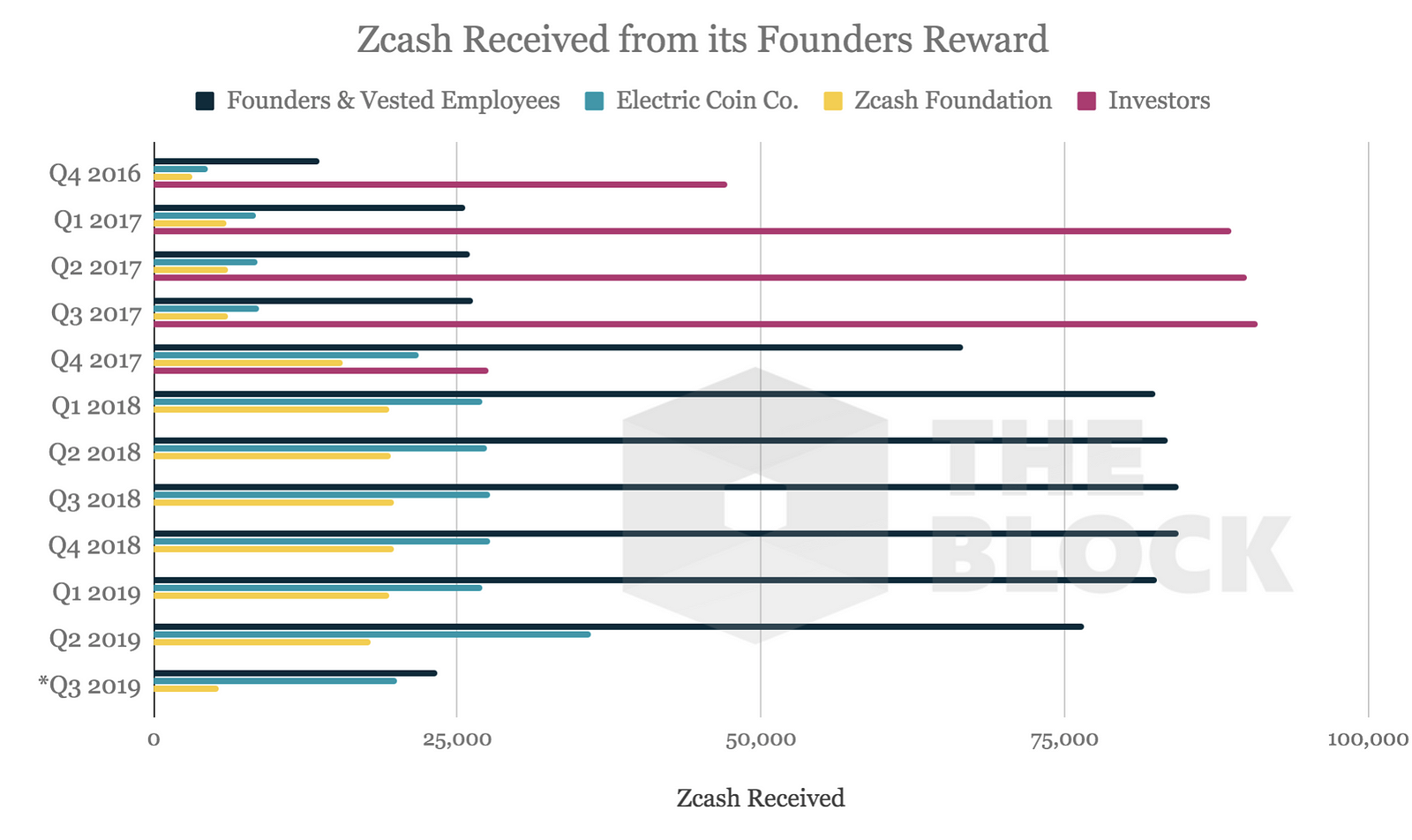

Due to operating at a deficit and market uncertainty, a dilution was put in place in June where additional funds were allocated to ECC to ensure its ability to operate. Prior to the dilution, the breakdown of the 20% for four years that went to founders reward recipients was as follows: 12.8% to founders and vested employees, 4.2% to Electric Coin Co. and employee compensation, and 3% to the Zcash Foundation.

The founders reward has now been adjusted to 9.6% to founders and vested employees, 8.2% to Electric Coin Co. and employee compensation, and 2.2% to the Zcash Foundation.

While these numbers have been used for our calculations, it is also important to note they have changed a bit over time due to vesting schedules, where part of the employee compensation that we’ve grouped together with Electric Coin Co. changes to Founders and Vested employees as an employee becomes vested.

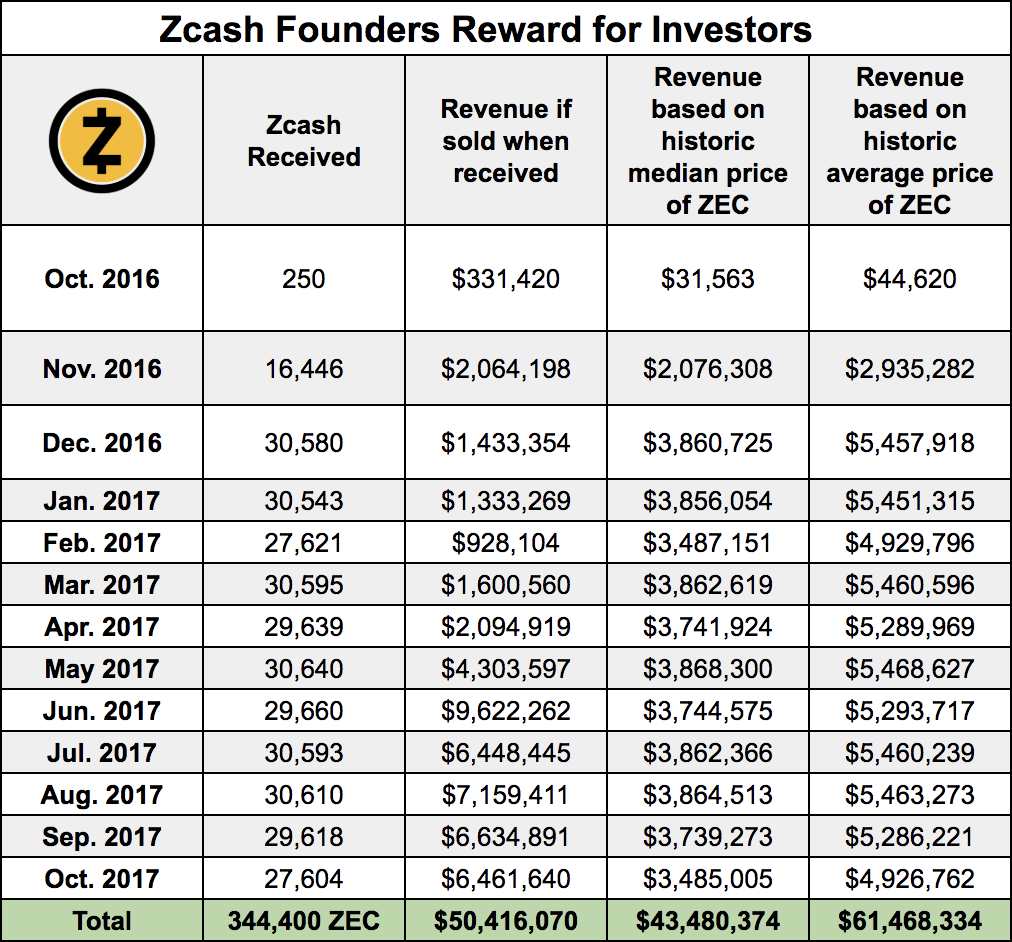

Investors

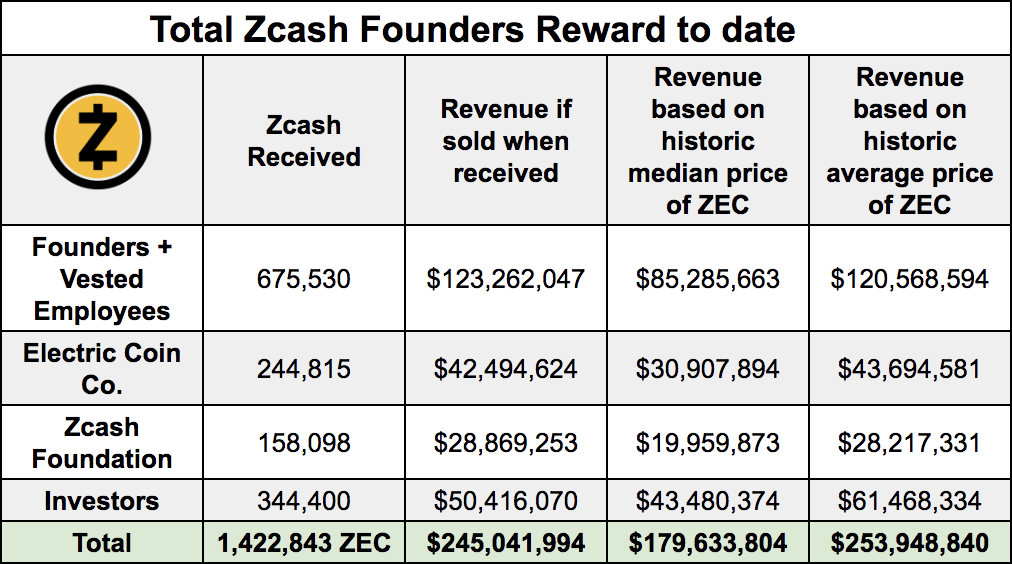

For the purpose of this piece we won’t expound too much on the investors' portion, as we have outlined and analyzed these recipients and what their possible return on investment was. Since investors received their full amount of 344,400 ZEC during the first year, they received about 69% of the founders reward during that period, leaving only about 31% to be divided between Electric Coin Co., The Founders and vested employees, and the Zcash Foundation.

The portion of ZEC that went to investors would have been worth the equivalent of $50,416,070 if it was all sold on each day it was received. Based on the historical median price of $126.25, this portion would be valued at about $43,480,374. While using the median price may be more appropriate because the price of ZEC is highly volatile, based on the historical average of $178.48, the portion would have been worth about $61,468,334

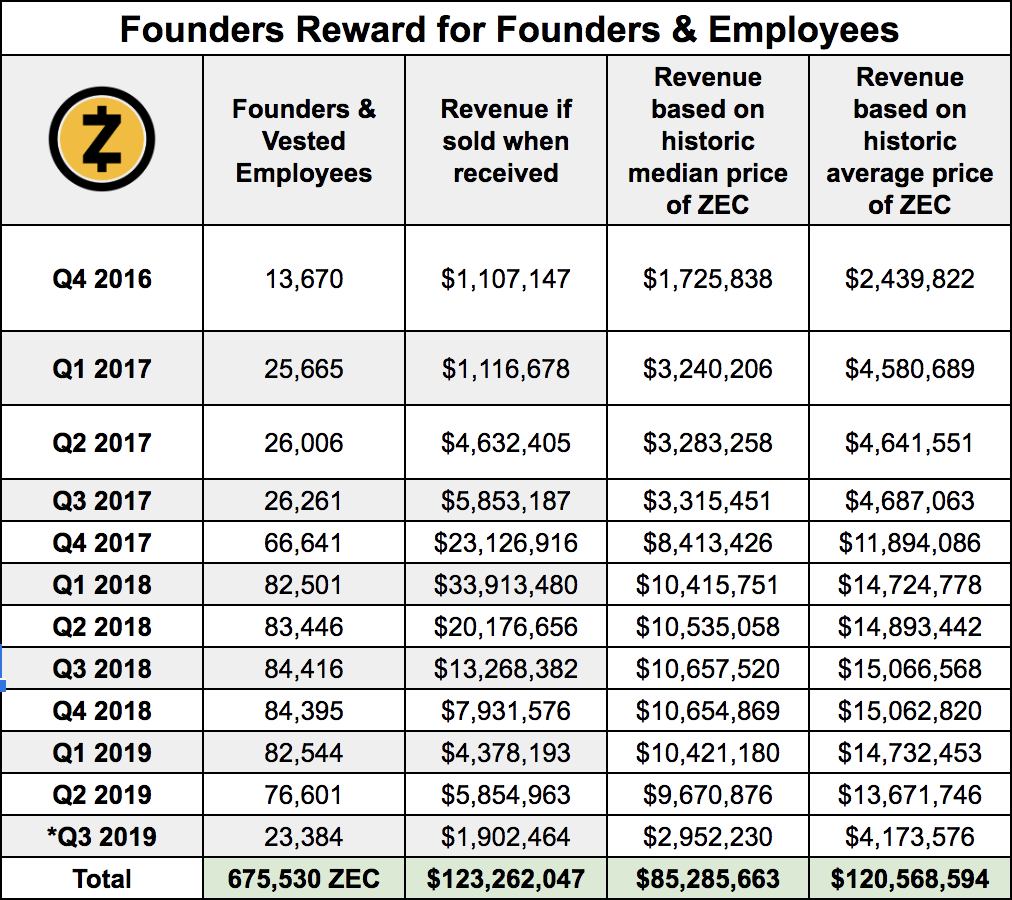

Electric Coin Co. and Employee Compensation

As a whole, other than the miners who have consistently received 80% of the mining rewards, the portion for Founders and vested employees has been the biggest share (excluding first year where investors received their full amount). To date, this portion would have brought in 675,530 ZEC or $123,262,047 if the Zcash was consistently sold on the days it was received. Based on the historical median price of Zcash, the founders and vested employees have made about $85,285,663. Using the historical average price of ZEC, the value received is much closer to if it was sold each day, at $120,568,594.

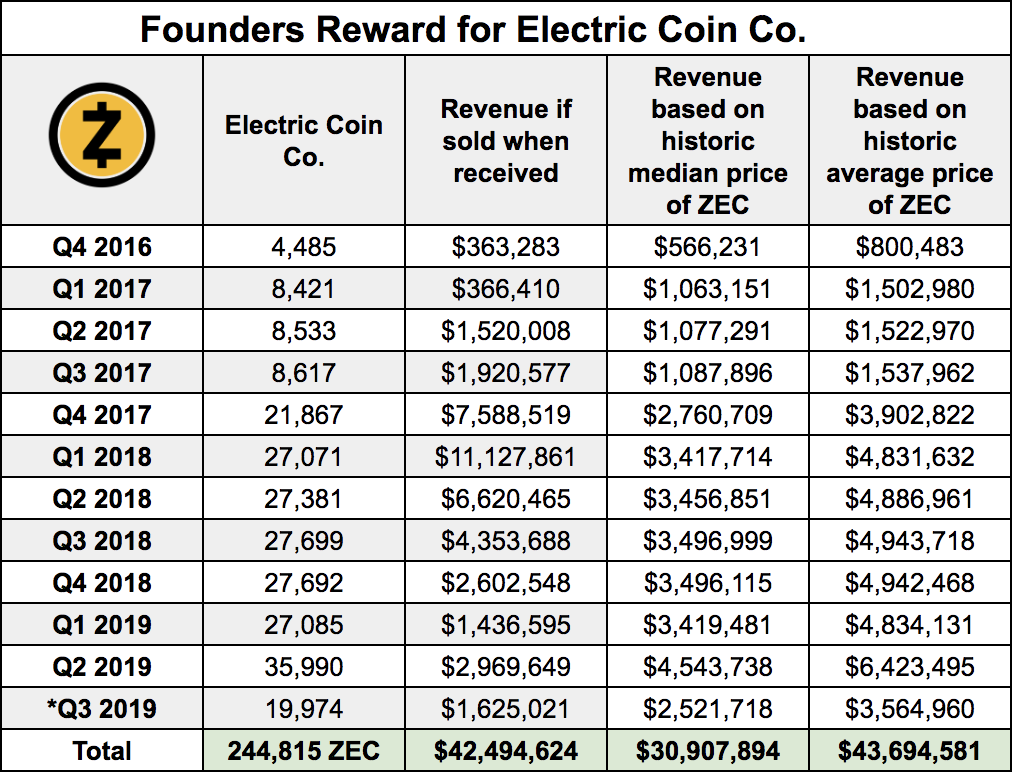

Electric Coin Company

In this category we included the full portion being used for the company and its employees. The company has received 244,815 ZEC, which would have amounted to approximately $42,494,624 if the rewards were sold each day they were received. By using the historic median price of ZEC we come to about $30,907,894 and with the historic average the rewards would have generated about $43,694,581.

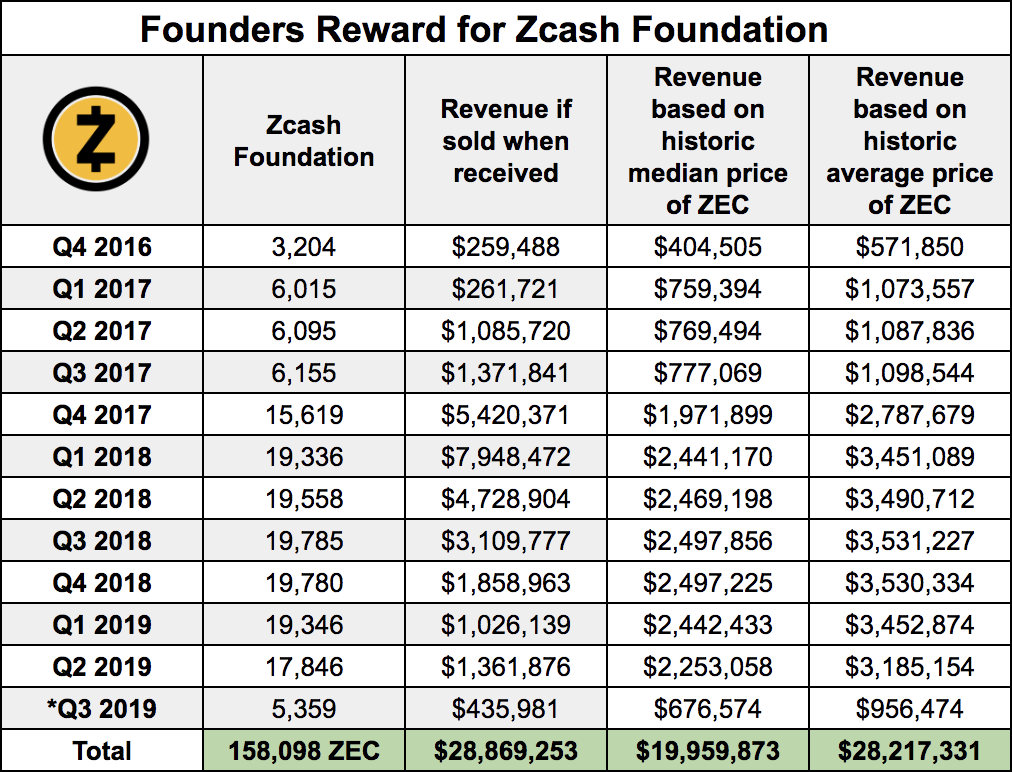

The Zcash Foundation

The Zcash Foundation is a separate entity that operates as a 501(c)3 nonprofit. As of Aug. 3, The foundation has received a total of 158,098 ZEC. If the foundation had sold all of the ZEC it received each day it received them, it would have generated approximately $28,869,253. Based on the historical median price of Zcash, the foundation would have been able to generate about $19,959,873 and based on its historical average price it would have received about $28,217,331 for its operations.

The Founders Reward Combined

As of Aug. 3, 2019, the founders reward has generated a total of 1,422,843 ZEC. We can estimate that the current total of the founders reward would have generated approximately $245,041,994 if it was sold on the corresponding days it was received. Based on the historic median price the founders reward would have generated about $179,633,804 and using the historic average it would have generated approximately $253,948,840.