NFT Collection The Superlative Secret Society Price, Stats, and Review

Best Crypto to Buy for Long-Term Gains: Pepeto Presale Predicted to Soar

South African Crypto Exchanges Push for Regulatory Change to Allow Pension Fund Investment

Dogecoin (DOGE) Enthusiasts Earn $5,720 a Day Through Cloud Mining

WhiteBIT TR and Misyon Bank Sign Agreement

Should Ethereum's Market Dominance Be Challenged? Exploring Cardano's Breakout Potential And Yeti Ouro As The Next 10X Meme Coin

Potential New Coins Coming to Coinbase in 2025 Upcoming Coinbase Listings That Could Grow Your Portfolio 100X in Weeks

Dogen’s $0.0015 token could deliver 25,000% returns before BTC hits $100k

Gender imbalance in web3 tech space | Opinion

Lummis to Lead SBC’s Crypto Subcommittee Under Trump

Priced Below $0.20, This Token Could Dominate the Market Like Ethereum (ETH) or Binance Coin (BNB) and Hit $50 By 2026

Earn up to 2.5% daily by investing in Moonacy Protocol’s liquidity pool

Largest Bitcoin ETF Provider BlackRock Selling Spree Kickstarts, What’s Next?

Grayscale Considers DOGE, HBAR, AI16Z Among 39 Crypto for Investment Products

Binance Lists ChainGPT (CGPT): Unlocking a New Era for AI-Powered Blockchain Solutions

Bitcoin capital outflows – Reset for $60k or a launchpad to higher levels?

SAFE rallies 20% on Bithumb listing

CFTC Reportedly Subpoenas Customer Info from Coinbase Related to Polymarket Probe

How High Can Shiba Inu Price Rise in Jan 2025?

Top 6 Cryptocurrency Payment Gateways for International Businesses In 2025

Circle Joins Big Tech in Donating $1 Million to Trump’s Record Inaugural Fund

Experts believe this new crypto will 50x the gains of SHIB, SOL, and XRP in 2025

Solana Price Today: Will SOL Overtake BNB Again?

Incentive programs are sweeping crypyo exchanges, but they don’t look like anything Wall Street has ever seen

Everyone has a life before crypto.

Prior to my days as a bitcoin scribe, I covered Wall Street's largest brokers, high-frequency trading firms, and exchanges. I know what you're thinking. Sounds ghastly boring.

Looks can be deceiving. The infighting, competition, and legal battles that encompass U.S. equity market structure, in some respects, holds a candle to the Wild West world of digital assets. One need look no further than the debates over rebates: a discount scheme by which exchanges pay brokers for orders that add liquidity to their venues. Indeed, the U.S. Securities and Exchange Commission is fighting to implement its "Transaction Fee Pilot," which would examine how rebates impact broker behavior. Some have argued that rebates add conflict to the markets inasmuch as brokers have an incentive to route orders to where they might get the best-paying rebate, not where their clients will be best executed. Exchanges claim rebates have tighter spreads, making trading cheaper for all market participants.

NYSE, Nasdaq, and Cboe — the three largest equities exchanges in the U.S. — are suing the SEC over the pilot.

In crypto, these debates have yet to find their way into public discourse. But that's not for a lack of wonky incentives and rebate programs.

Indeed, just yesterday I reported CoinFLEX, a Hong Kong-based firm, is rolling out a new market maker incentive program to lure new volumes to its burgeoning marketplace.

CoinFLEX plans to offer the top firms a rebate of $250,000 in total if daily volumes for its XBT/USDT futures hit $500 million. Currently, three firms are quoting under the terms of the market making program. CoinFLEX’s aim is to sign up 10 qualifying firms, which would be required to tighten spreads on the platform.

If the firm’s XBT/USDT futures beats BitMEX similar perpetual swap contract in trading volumes in the month of December, a moon-shot bet, then those market-making firms would receive $1 million each.

Kraken's futures markets has a similar scheme. The firm offers a revenue sharing opportunity for all of its traders, equal to 30% of the fees its earns from trading. To be clear, Kraken's program is not target at a specific clientele-type.

"We pay 30% of our revenue back to traders, with a minimum payout of $25,000 per week. At the end of every week, each trader’s contribution to the liquidity pool is calculated and their share of the revenue is paid out accordingly," according to the exchange's website.

To be sure, comparing the market structure of crypto to that of U.S. equities, is akin to comparing apples and oranges. Or as ICE's data head Lynn Martin said to me during an interview, it's akin to comparing apples and "neon fluorescent signs."

Still, these schemes are striking to the trading experts I spoke to this week. Not because they're better or worse than what is going on in traditional markets — it's just very different.

"I've never heard of this happening on a futures exchange," said Russell Rhodes, a derivatives analyst at consultancy Tabb Group, specifically referring to the reward structure set up by Kraken and CoinFLEX.

Typically, incentives are provided to get a market or product up and running in the beginning — not months, in CoinFLEX's case, or in Kraken's case, years into the existence of a venue or product. Also, in U.S. derivatives markets, such incentive programs are filed with the Commodities Futures Trading Commission, which has to approve them.

"I feel like if you had a legitimate platform, you wouldn't have to do anything like this," he said, pointing to Chicago-based cryptocurrency derivative marketplace. "ErisX doesn't appear to be doing anything like this. Seed CX isn't doing anything like this."

"What's to stop two of these guys from getting together and trading back and forth with each other to increase the volume?"

There are exceptions in traditional futures.

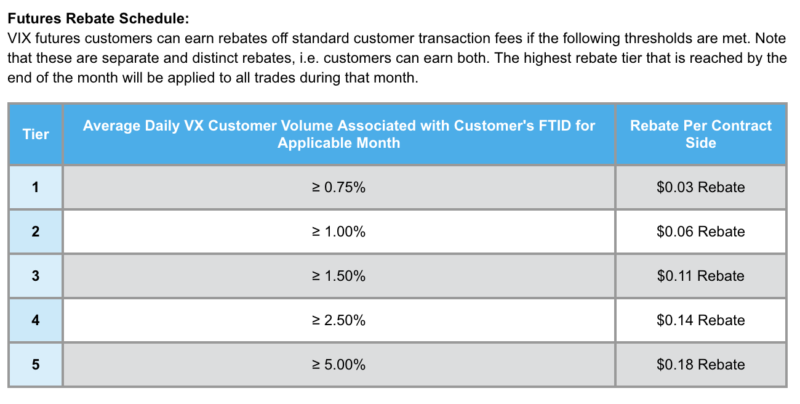

VIX futures traders on Cboe, for instance, can get earn a $0.18 rebate if they contribute to more than 5% of trading volumes in a given month.

Traditional derivatives marketplaces — not necessarily the exchanges themselves — also have their own peculiarities. In futures, typically the exchanges don't offer incentives, aside from caps on fees for large volume traders, for instance. In options, things get a bit more interesting, according to Thom Thompson, a contributing editor at John Lothian News.

"That's where the real whore house is," he said, referring to the practice of payment for order flow in options trading.

Deals are made between brokers, trading on behalf of clients, and exchange-designated market makers. Broker A, which could direct its customers' trades to any of a number of market makers in a given option operating on one of the umpteen options exchanges, can direct the order to the exchange whose market maker gives the best incentives as long as the customer gets the national best fill price.

"It's pretty messy and complicated."

Interestingly, Thompson offered a warning to the crypto world from his time at Eurex.

"We really couldn't find examples of where these rebates helped any futures product. It's almost a surrender flag — you're saying your product couldn't work on its own."