NFT Collection The Superlative Secret Society Price, Stats, and Review

BTC, ETH, and XRP may drop further; here’s how to manage a portfolio during a downturn

Panshibi Hype Builds As More Cardano & XRP Holders Join The Presale Ramping Up The 100X Potential Post Launch

Pundit Sounds Major Crash Alarm For XRP Price As ’12-Year Cycle’ Comes To An End

As BTC struggles below $100,000 investors seek profitable altcoins

TAO and Arbitrum investors rush to buy into 1Fuel presale before anticipated rally

Dogecoin Daily News; DOGE Price Prediction This Month; Remittix Takes Centre Stage As Altcoin Gains Mass Media Attention In Early 2025

Crypto in Focus: New York Senator Calls for Industry-Wide Impact Study

This Cardano Rival Could Be Set to Enter Top 20 After Listing, Inflows Show $2.8M From DOGE Whales

3 Crypto Tokens Unaffected by the Bear Market: AVAX, RBLK & OM - Experts Explain Why

Bitcoin L2 Hemi captures $260m TVL ahead of mainnet launch

XRP could soar 30% to reach $3.22 only IF…

3 High-Potential Altcoins to Watch as BNB Price Jumps 13%

Ethereum price forms a death cross as whales dump

Bitcoin Market Prepares For CPI Data Release Shockwave, But Rebound Hopes Grows

Holders are swapping their Ethereum for this trending altcoin

Crypto Gems for Investors – Solaxy ICO Raises Over $20 Million for Solana Layer 2 Meme Coin

Cardano Gains Momentum After Spot ETF News, ADA and RTX Both Post 5% Gains In Past 7 Days

Robinhood Reports Record $1 Billion in Q4 Revenue, Crypto Trading Soars

Cardano Texas Millionaire Splits ADA Bag With New Crypto Coin Coldware (COLD), Here's Why

RBLK in Final Stages of Presale! Ready For Listing on Major Exchanges, Could it Rival DOGE?

Why Have So Many Shiba Inu (SHIB) Holders Joined the Panshibi (SHIBI) Presale and Could 100X Gains Be on the Horizon?

CEX.IO enables spot trading for UK customers

FBI Unveils $15M Crypto Kidnapping Case in Chicago

Crypto task force bill introduced in New York – What it entails

Bitcoin Miner Capitulation of New Gen. Will Begin at This Price: Analyst

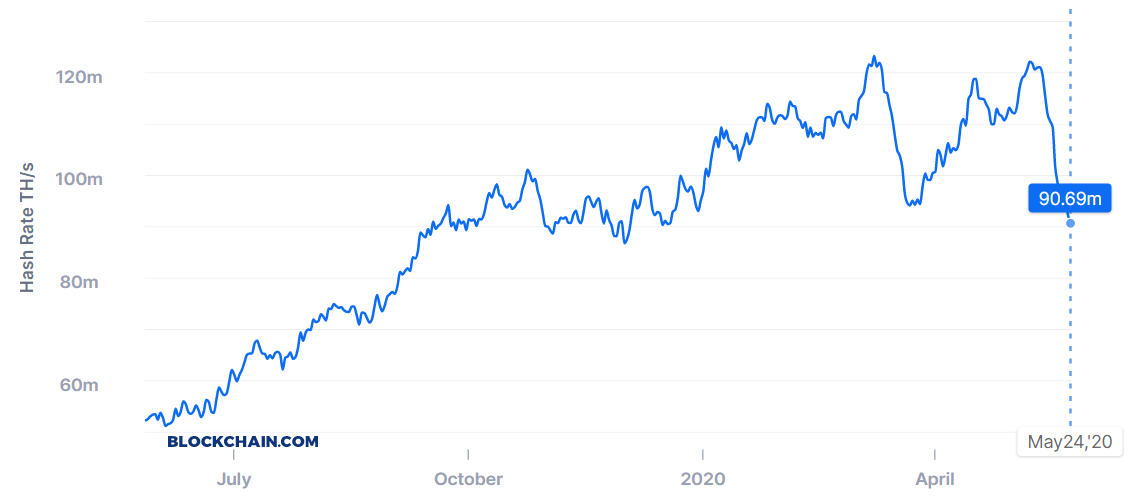

The total Bitcoin [BTC] hash-rate has fallen below COVID-19 crash levels, and this time around exit seems to be permanent for the older generation of miners. Nevertheless, there is a silver lining with the rainy season arriving in China.

The levels around 85-90 million TH/s marked the bottom in hash-rates during the bear market of 2019 when the prices fell to around $7,000. The miners continue to exit even after the recent difficulty adjustment of 6% on 19th May, pointing out the unprofitable price levels.

Bitcoin [BTC] Total Network Hash-Rate (Source)According to Dovey Wan, crypto analyst and investor, the capitulation could continue to push the price lower. She tweeted,

Bitcoin [BTC] Total Network Hash-Rate (Source)According to Dovey Wan, crypto analyst and investor, the capitulation could continue to push the price lower. She tweeted,

“The first drop of hashrate comes after 3/12 black Thursday, tho temporarily as price bounces back quickly in a month. Most miners can shut down for a month, but it’s like holding their breath.” she added, “the second drop comes after halving and this time will continue for a while if the price keeps ranging (last for a few more difficulty adjustments cycles)”

Electricity Cost and Revenue Ratio

According to previous estimates, the marginal break-even cost for the new gen. of miners was around $10,000. However, Wan points that it is a gross over-estimation. Assuming the cost of electricity to be around $0.04 per kWh, the marginal cost of “WhatsMiner M20s 65T is around $5,000, with its flagship M20S+ will be ~$4000 per BTC.” The cost of S17 and S17+ should be comparable as well.

Nevertheless, as stated before, the S9 systems are effectively being driven out. She introduced the cost to revenue ratio, an important metric which varies with price. For new gen, the ratio is still below 1, making them profitable. While in the future old generations find relevance during extreme bull markets, but at present capitulation is more likely. She said,

Before the halving S9’s E/R is <1, now, assuming $0.04/kwh is 1.19, so all S9 need to shut down after halving at current price

While the markets expects the exit of S9 and possibly S15 miners, a further drop in price could accelerate the selling pressures among newer models as well. The rainy season stands to improve the ratio by about 25% as the cost of electricity is decreased due to the availability of abundant hydro-power, which is bullish for the hash-rates in the short term. It could take around 6-8 weeks of times to find an equilibrium in the supply schedule of Bitcoin [BTC].

Do you think that the price can drop below the marginal break-even levels? Please share your views with us.